Welcome to LBO Software for Deal Professionals

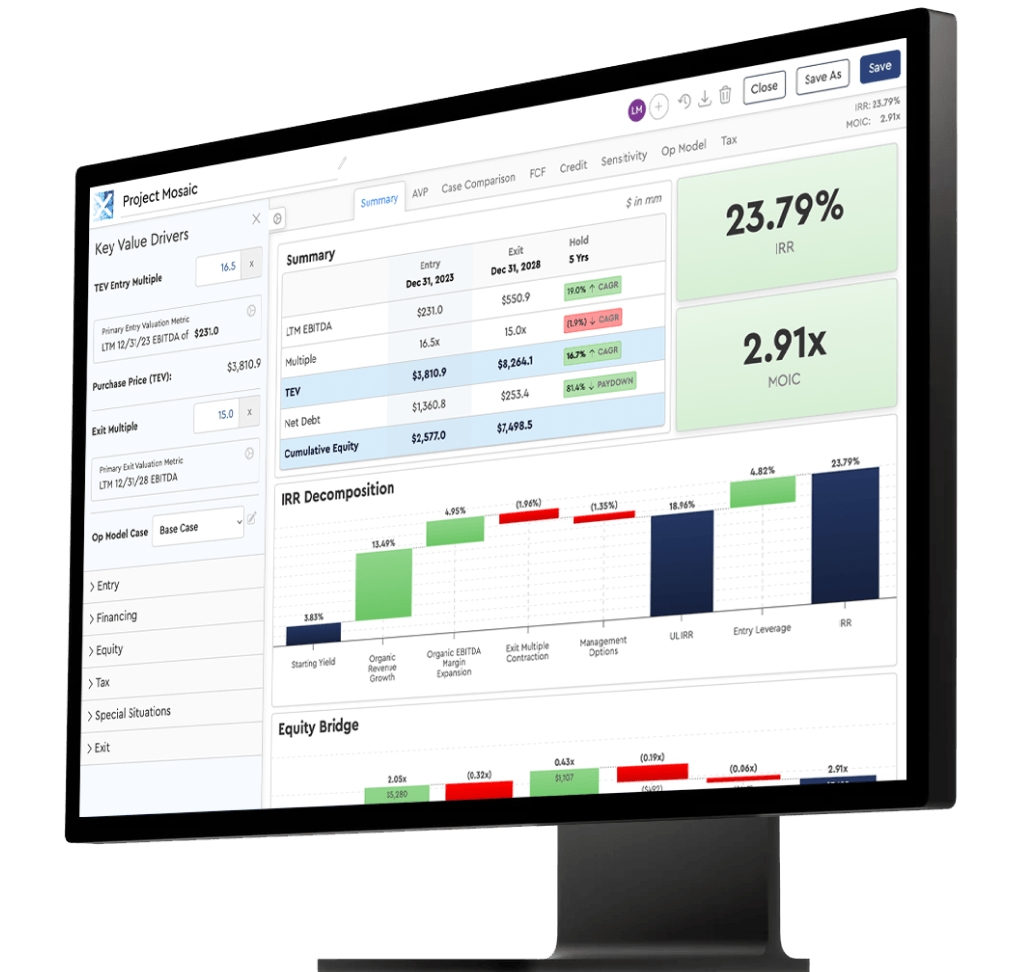

Discover assumptions-driven modeling.

Trusted by the World's Most Successful Investors & Advisors

Move at the Speed of the Market with Mosaic

Increase your deal team's effective capacity

A home-run opportunity should never be missed because of tight staffing.

Increase your effective capacity by working smart at the start of the deal funnel.

Deal teams save significant time using Mosaic - time that can be repurposed to more value-added activities, including reviewing additional investment opportunities.

The new deal funnel

Every investment firm has a funnel like this one. The volumes will differ, but the shape will be similar.

Whether you look at 10 or 10,000 deals a year, you likely only dive deep on a subset - and take fewer than 2% to the finish line.

Capture a view on value for your full funnel - saving you time and building institutional memory on each deal reviewed.

Real-time collaboration

Harness the brainpower around your table.

Firms that have adopted Mosaic firmwide are leveraging the platform to facilitate valuation discussions within deal teams before a major milestone (e.g., investment committee, bid submission, etc.).

Screen-share your Mosaic model virtually or in a conference room and flip between individual deal team members' personal operating cases to debate key differences and arrive at your collective view of the truth.

Mosaic is my go-to tool as a mega fund private equity Associate – it allows me to accelerate the tedious task of building a model’s infrastructure and allows for seamless collaboration through the intuitive visualizations. Mosaic is the future. This will become the new standard.

I love this platform. It’s quick, intuitive, and saves me and my team hours of iterating on Excel models.

Less time linking, more time thinking! Finally, private equity is becoming tech-enabled.

The Mosaic modeling tools are the greatest innovations I have witnessed in my career as an investor. The over-utilization of junior resources is perhaps the largest problem facing the financial services industry and Mosaic addresses that head on. Mosaic easily saves my team 10+ hours on each investment opportunity, freeing up hours for value-add work streams. I hope this becomes ubiquitous across the industry, so Mosaic proficiency is regarded in the same vein as PowerPoint or Excel proficiency.

Mosaic's modeling tool helps me (i) form a view quickly on the basic return parameters for a deal and (ii) check an associate's model much more quickly. I save a ton of time and it's a much easier user interface than clunky Excel.

Mosaic saves me hours of time checking my Associates' models between the dozens of case iterations leading up to IC.

Mosaic's Quick LBO gets me 95% of the way to an answer without 99% of the work. Like BamSEC and CapIQ, it's become a must have tool that supports a better work life balance and a healthier culture while improving our productivity.

Running Mosaic is the first thing I do when I receive a new model to review and the last thing I do before sharing with my MD.

If the outputs line up perfectly – or if I understand and accept why they don’t – I have full confidence in my Associate’s model.

Achieving that level of certainty without Mosaic used to take me hours.

Mosaic’s fully functional and well formatted LBO models unlock time for Associates to focus on value-additive tasks and demonstrate their true capabilities. The models also include helpful tools, such as IRR decompositions, which massively help in creating a thoughtful diligence plan.

Request a Demo

Reach out to learn how investment professionals across the globe are leveraging Mosaic to work more efficiently.

Our team will get back to you within one business day.